- TOP

- Search

- Coupons / benefits search results

- TOBU Department Store Ikebukuro [tax-free procedure guide]

TOBU Department Store Ikebukuro [tax-free procedure guide]

Keyword:

-

Ikebukuro

-

tax-free Japan

-

Japan shopping

-

tax-free procedure

-

tax-free

-

tax-refund

-

shopping

-

travel information

- Categories

- Privilege

- Shops

- Tobu Department Store Ikebukuro

- Area

- Kanto Tokyo

- Period of use

- 2025-03-11 15:00 - 2030-03-11 20:00

- Place of use

- Tobu Department Store Ikebukuro

<Tax refund guide>

We refund the full amount of consumer tax in cash. (without handling fee)

Tax will be refunded at the tax refund counter.

Please be advised that, in accordance with National Tax Agency standards, tax exemption procedures may not be accepted for purchases that exceed a certain level of frequency, volume, or quantity in order to prevent abuse.

■Tax Exemption Eligibility: Non-residents who fall under the following (no proxy allowed)

・Foreign Nationals

・Those with “Temporary Visitor (stay in Japan less than 6 months)”, “Diplomat” or “Official” status

・Those who are staying in Japan with a “crew landing permission”, etc.

・U.S. military personnel (those who entered Japan under the Status of Forces Agreement)

・Japanese nationals (whose period of stay in Japan is less than 6 months)

・Those who can be confirmed by documentary proof (*1) that they have been continuously residing abroad for more than 2 years.

(*1) Proof of residence is a “proof of residence (*2)” or a “copy of the family register (*3)” (both originals) made on or after the date 6 months prior to the date of return to Japan.

(*2) “Date of establishment of domicile or residence” and the place of permanent domicile must be indicated.

(*3) The place number of the permanent domicile must be stated.

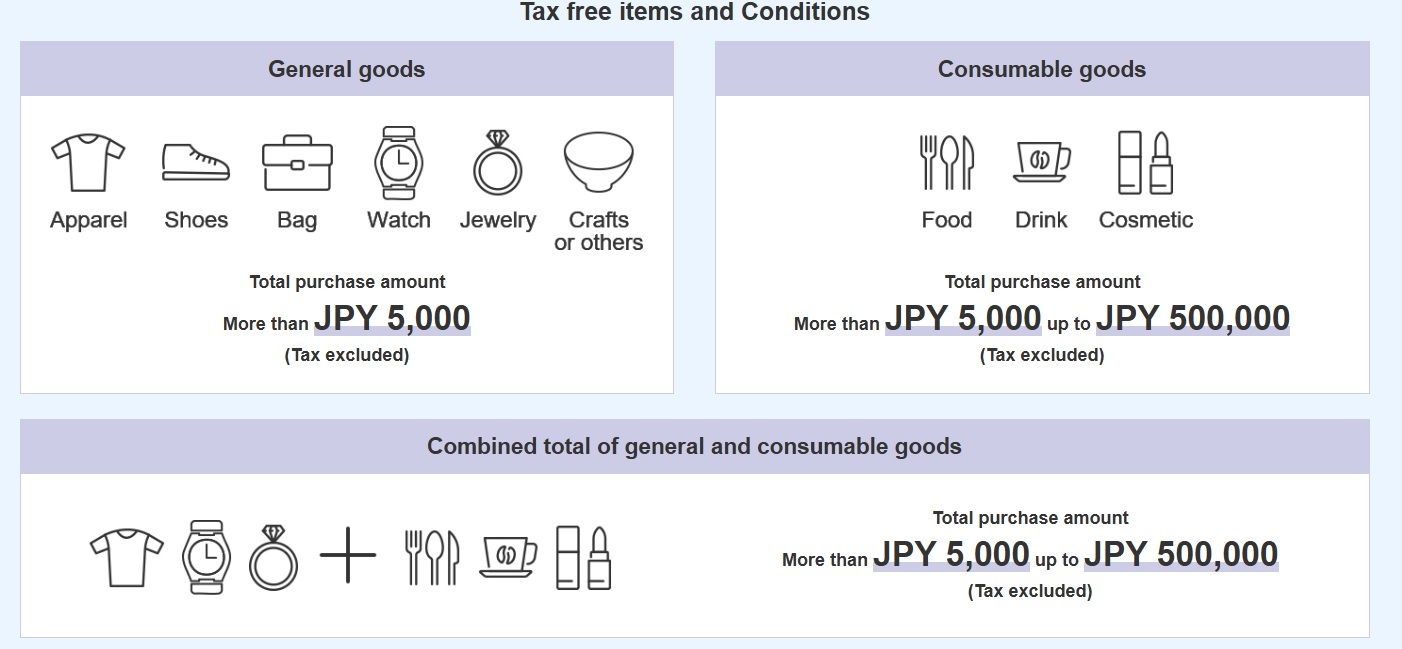

■Eligible items and condition of tax refund

ーーーーーー

General items (clothing/shoes/bags/watches/jewelry/crafts, etc.) purchases totaling 5,000 yen or more (excluding tax)

Consumables (food, beverages, cosmetics, etc.) Total purchases of 5,000 yen or more up to 500,000 yen (excluding tax)

Total of general goods and consumables Total purchases of 5,000 yen or more up to 500,000 yen (excluding tax)

ーーーーーー

*Please make sure to bring it out of Japan within 6 months after your entry.

*“Consumables” and “combination of general items and consumables” must be packaged at a tax refund counter. They cannot be opened or used in Japan.

■What to present

①purchased items

②Own passport (not available with the copy or ID), Landing Permission

*For foreign nationals who entered Japan with their own passport may also provide "Visit Japan Web tax-free QR code"(not available with screenshot).

③Receipt (invoice is not available)

④Credit card, applications (only when you used them)

*The name on the passport must match the name on the credit card or applications.

⑤Proof of residence or a copy of the family register, for Japanese nationals

■Notice

This service is available for products purchased for personal use.

(Products purchased for business use or for sale are not eligible for tax refund.)

・Please be sure to take duty-free purchased goods out of Japan.

・Please present your passport at customs when leaving Japan.

・If you are not in possession of your purchased items, you will be charged consumption tax.

・Even if you are using an automated gate or a facial recognition gate, an entry stamp (seal of approval) is required.

・Please follow the import regulations of your country.

・Diplomatic passport holders working in diplomatic missions abroad are not eligible for tax refund.

・Food and beverage, shipping charges, fresh food, prepared foods, fresh confectionery, plants, repair and processing fees, and some stores are not eligible for tax refund.

・Tax refund is available only on the same day of purchase (during business hours).

・In principle, returns cannot be accepted after tax refund procedures have been completed.

◎Please ask the staff at the tax refund counter for details.